In a nutshell:

- Churn analysis is crucial for businesses to measure customer retention and identify potential issues.

- Predicting churn allows businesses to take proactive measures and implement targeted strategies to retain customers.

- Predicting churn empowers businesses to be proactive, optimize customer retention efforts, and cultivate a more successful customer base.

- Pecan's churn prediction models enable businesses to take action to retain at-risk customers and improve overall customer satisfaction.

Why did the customer retention expert become a detective?

Because they were determined to solve the case of disappearing customers!

OK, that’s pretty silly. And hey, customer churn is no joke.

You’ve worked so hard to acquire existing customers, not to mention spending considerable time and resources on that task. You want to keep customers around and, if anything, build a stronger relationship with them.

Every year, businesses lose roughly $1.6 trillion to churn. In some industries, up to a quarter of customers churn each year. That represents a huge revenue loss and a poor customer experience.

If you suspect you’re dealing with a high churn rate and want to improve your customer retention metrics, the first task is to calculate customer churn accurately and ensure you have an accurate handle on the problem.

First, let’s explore why customer churn matters so much to businesses. Then, we’ll examine how to calculate customer churn over a given period and some potential ways to begin solving this challenging problem, including customer churn prediction.

Why analyze customer churn?

Churn analysis helps identify pain points in the customer journey, allowing for improvements in products, services, and communication. Customer churn is inevitable, but analyzing its frequency and causes is invaluable.

In business analytics, accurately calculating and detecting churn is crucial for ensuring customer retention and gaining insights into a customer base's overall health.

Churn refers to the rate at which customers terminate their relationship with a company within a specific time frame. Precisely measuring churn enables businesses to identify patterns, diagnose potential issues, identify warning signs, and devise strategies to bolster customer loyalty. Some of the causes of customer churn include:

- New competitors entering the market

- Poor service quality

- Lack of product usage

- Better prices are available elsewhere

Resolving Customer Churn Issues Proactively

Until recently, customer experience directors, brand managers, and customer success teams haven’t had a way to anticipate and take action to prevent churn. Predictive customer churn software may offer a path forward. It can be difficult to spot warning signs of churn.

Looking at spreadsheets or traditional BI tools isn’t sufficient to identify complex patterns of customer behavior that precede churn. So many potential factors affect customers’ purchasing decisions, making reducing churn.

Predictive models built with predictive churn software can find those critical patterns in the data. These models rapidly determine which customers are more likely to churn. This software doesn’t just analyze what happened in the past. Predictive analytics gives you a glimpse of customers’ behavior in the future. That includes the ability to predict which existing customers might leave.

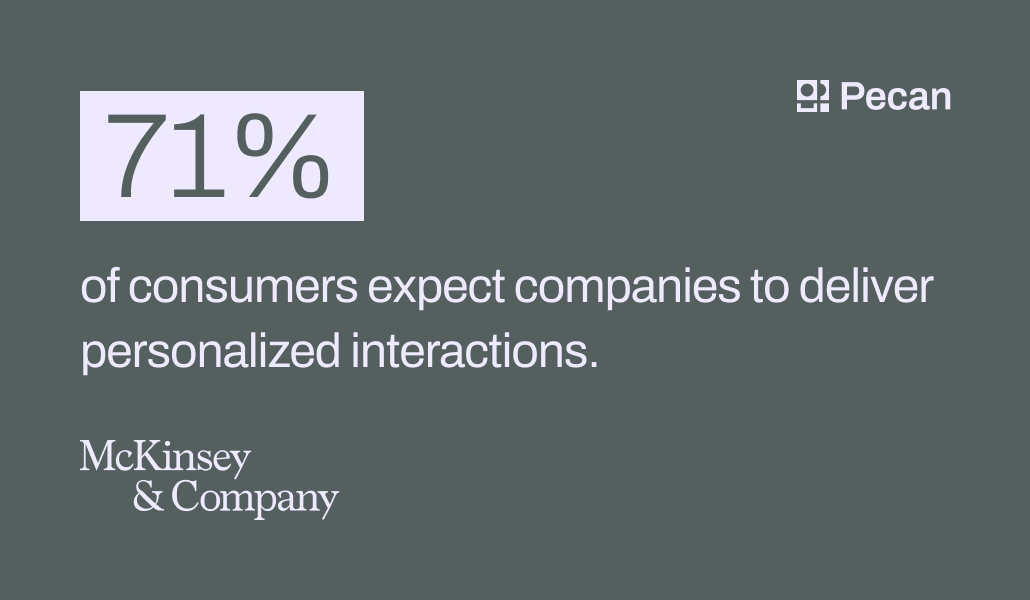

Anticipating customer churn lets you deliver personalized experiences to at-risk customers — before it's too late.

That advance knowledge lets you plan what you’ll offer customers so you can keep them loyal and happy. You’ll lower your churn rate and boost customer retention — and your bottom line. Predictive churn software is useful in many industries and departments. These include SaaS companies, direct-to-consumer businesses, consumer packaged goods, and mobile apps and games.

Additionally, it's helpful to think of customer churn as an indicator of growth opportunities. With careful churn analysis and predictions of customer churn risk in hand, companies can not only increase retention but also target areas of improvement and innovation that would benefit from investment. Knowing what causes customers to churn can provide significant inspiration and motivation for change.

According to Databox, 2/3 of companies do churn modeling in some form, with 80% doing a predictive churn analysis. If you're not already on board with this approach, maybe the next section will convince you.

What is the impact of customer churn?

It’s alarming that businesses suffer significant financial losses due to churn, amounting to approximately $1.6 trillion annually. In specific industries, as many as a quarter of customers churn yearly, resulting in substantial revenue loss and a less-than-ideal customer experience.

When a customer decides to leave, it can hit a business right in the wallet, costing them an average of $243. That’s not just a simple number – it takes into account how much customer acquisition costs in the first place, the recurring revenue that’s now gone, and even the potential damage to the brand’s reputation.

Of course, it’s worth mentioning that this number can fluctuate quite a bit depending on the industry you’re in. For example, for SaaS companies targeting smaller businesses, a monthly churn rate of 3-5% is to be expected.

Conversely, those serving enterprises can anticipate a much lower churn rate of just 1%. Aside from the thousands of dollars (or more) your company could lose as a result of churn, there are more good reasons to avoid churn.

Avoiding Churn: Reason 1

Attracting a new customer can be 6-7 times more expensive than retaining a new one. Even if you replace every customer you lose to churn with a new customer, you’re still losing money. The best way to maintain your success is to retain the customers you already have.

Avoiding Churn: Reason 2

A single negative experience will turn a third of your customers away from your business. It doesn’t take much for a customer to churn. A seemingly minor issue can be enough to propel a customer into the arms of your competitors.

Avoiding Churn: Reason 3

Only one in 26 customers will launch a complaint when they aren’t happy. Most dissatisfied customers leave quietly — they’re out the door without a word. You don’t even know in advance that they’re disappointed, and you don’t get a chance to fix the relationship. The absence of customer feedback doesn’t imply satisfaction.

Without using predictive analytics to identify and address churn risk, your business is operating in the dark. Fortunately, this innovative technology can increase your confidence in maintaining your customer relationships.

Customer churn analysis and prediction help you develop an effective game plan for identifying and nurturing your at-risk customers.

What is the best way to analyze churn data?

Determining churn rate involves various approaches offering unique insights into customer attrition. Calculations can be simple or complex, depending on what matters most to your business.

For example, you may want to include revenue when you calculate churn if your focus is understanding the revenue impact of churn.

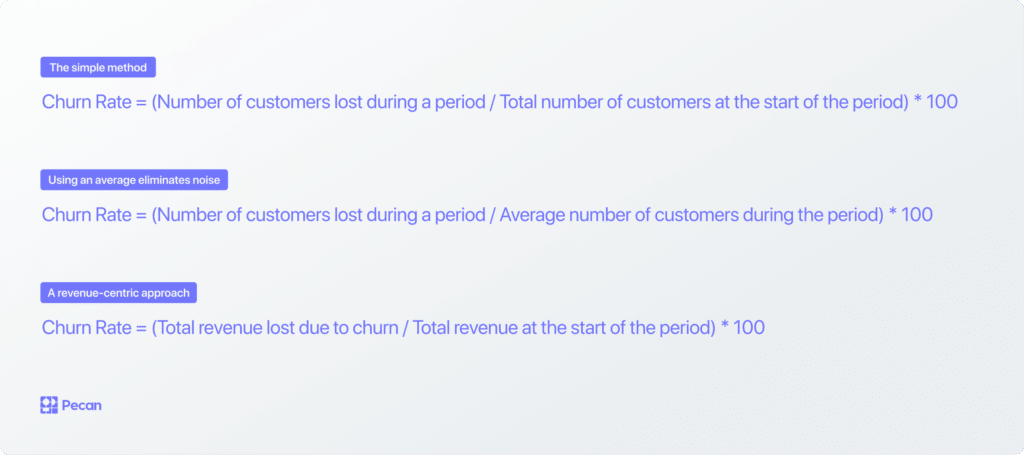

Additionally, predictive analysis provides a much more proactive approach. Let’s explore three commonly used retrospective methods using historical data:

Method 1: Churn Rate = (Number of customers lost during a period / Total number of customers at the start of the period) * 100

This method calculates the churn rate by dividing the number of customers lost during a given period by the total number of customers at the beginning of that period. Multiplying the result by 100 provides the churn rate as a percentage. This method offers a simple way to measure churn.

Method 2: Churn Rate = (Number of customers lost during a period / Average number of customers during the period) * 100

Instead of using the initial number of customers, this method employs the average number of customers during the period. Considering the fluctuation in customer count provides a more accurate representation of the churn rate.

Method 3: Churn Rate = (Total revenue lost due to churn / Total revenue at the start of the period) * 100

This approach takes a revenue-centric perspective by measuring the percentage of revenue lost due to churn. It involves calculating the total revenue lost from customers who churned during the period, divided by the total revenue at the start of the period.

Three methods of calculating customer churn

Seasonal churn trends and customer lifetime value play a crucial role in churn analysis, providing valuable insights into customer behavior.

By analyzing numeric data, we can identify patterns and trends in customer churn, enabling businesses to make informed decisions. Understanding the reasons behind seasonal churn can help companies develop targeted strategies to retain existing customers during specific periods.

Additionally, customer lifetime value analysis helps businesses determine the long-term profitability of their customer base and prioritize efforts to keep high-value customers.

By considering these factors in churn analysis, you can take proactive measures to reduce churn and improve overall customer satisfaction. How can predicting customer churn help?

Predictive churn software has a big job — because churn is a big business problem.

Calculating churn is crucial for businesses seeking to gauge customer retention and identify potential issues impacting their bottom line. Understanding churn allows firms to allocate resources effectively, optimize customer retention strategies, and deliver exceptional experiences to retain their most valuable customers.

But measuring churn after it’s already happened isn’t ideal. Instead, anticipating customer churn offers significant advantages overreacting to it afterward. By being proactive and using customer churn prediction, businesses can take preventive measures and implement targeted strategies to retain existing customers before they even consider leaving.

This approach allows companies to stay ahead of the game, minimizing the impact of churn and maximizing customer retention.

On the other hand, reacting to churn after it has already happened puts businesses in a more challenging spot. It often involves scrambling to win back customers or find replacements, which can be costly and time-consuming. Plus, by that point, the adverse effects of churn, like lost revenue and potential damage to the brand, have already taken their toll.

With customer churn prediction through machine learning, businesses can allocate their resources more efficiently. They can focus on spotting early warning signs, analyzing customer behavior, and implementing personalized retention initiatives.

This proactive approach enables companies to be customer-centric, addressing issues rapidly and building stronger relationships with their clients. Ultimately, customer churn prediction empowers businesses to be proactive, optimize their customer retention efforts, and cultivate a more sustainable and thriving customer base. It’s like having a crystal ball that helps them stay ahead of the curve and minimize the adverse impact of churn.

How can you communicate your churn analysis effectively?

Once you've carried out a thorough churn analysis with any of the numerical or predictive methods described here, data visualizations can be extremely helpful in sharing your results with your team and the broader business.

Data visualization skills are crucial in today's data-driven world. Effectively conveying findings through visual representations is essential for decision-making informed by data analysis.

Additionally, dashboards play a significant role in communicating churn analyses on an ongoing basis. They centralize and present data in easy-to-understand charts and graphs. By utilizing dashboards, you can share a comprehensive view of your data, enabling others to identify patterns, trends, and insights more efficiently.

In any form, data visualizations for churn analysis facilitate quicker and more accurate analysis, making it easier for stakeholders to make informed decisions based on current churn analysis information.

Achieving negative churn: a business dream?

Negative churn, which occurs when expansion revenue outweighs lost revenue, can be a significant driver of growth for a company. It might sound too good to be true, but with effective churn analysis—particularly predictive analytics—and proactive customer relationship management strategies, negative churn is possible.

Negative churn is primarily thought of with companies operating under a Software as a Service (SaaS) model and other businesses relying on subscriptions. These companies often offer customers the chance to upgrade to more extensive plans or use additional services.

In the quest for negative churn, businesses can reduce churn rates and drive growth by understanding the reasons behind churn and implementing strategies to identify and engage with at-risk customers.

Using churn analysis to understand "good churn"

As is often cited (as in this article at the Harvard Business Review), boosting customer retention by just 5% can boost profits by 25% to 95%. Of course, businesses typically want to reduce churn due to its negative impact on revenue and growth.

However, once you deeply understand your churn analysis and have been able to predict future trends in churn, you might recognize that some customer churn is strategically beneficial:

- Customer Segmentation: It may make sense to allow lower-value or unprofitable customers to churn while focusing resources on retaining high-value customers.

- Product/Market Fit: In the early stages of a business, some churn may be acceptable as the company refines its product or service to better match customer needs.

- Strategic Repositioning: When a business shifts its focus, market, or product offerings, it may allow churn among customers that no longer align with its new direction.

- Transition to Subscription Models: When transitioning to a subscription model, initial churn may occur as customers adjust to the new pricing structure, leading to higher customer lifetime value.

However, it's important to note here that without a detailed and ideally future-focused churn analysis, you won't necessarily be able to identify which of your customers will likely churn for which of these reasons. Again, predictive churn analysis is critical to more informed decisions and long-term strategy.

How does Pecan predict churn?

Pecan AI’s low-code predictive analytics platform uses machine learning to help you predict and reduce churn quickly.

Using your customer and transaction data without additional data science resources, your data analysts can build sophisticated machine-learning models. These models can:

- Understand what influences customers’ potential to churn

- Detect 85% of would-be churn

- Lower churn by roughly 15-20%

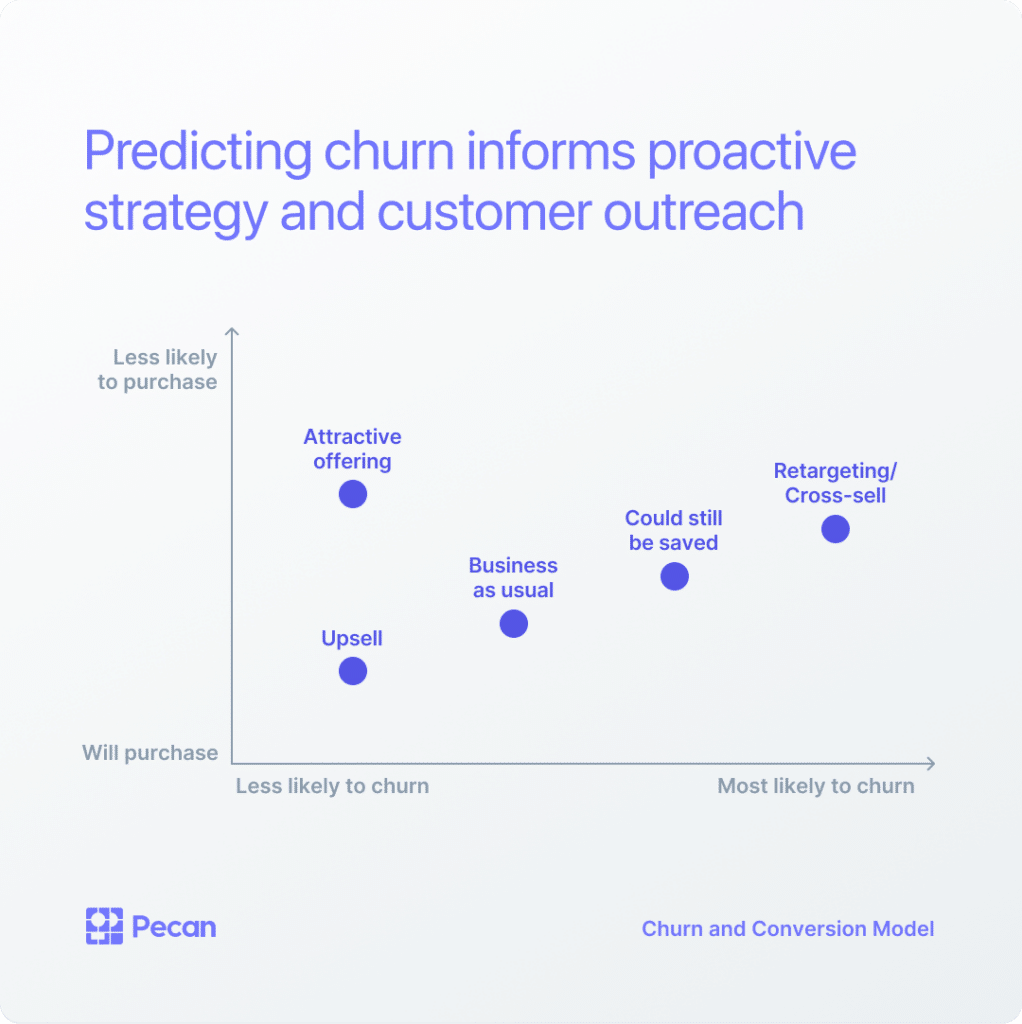

You can build a customer churn prediction model according to your business model (to address subscription churn, for example) or assign each customer a specific churn likelihood score. That score is essential to understanding and acting on the risk of churn.

Specific scores generated by the churn prediction model let you create groups of customers. Those defined groups can each receive targeted offers, promotions, or messages designed to keep their business.

Importantly, Pecan also explains the factors contributing to each score. These explanations allow you to choose how to take action to retain at-risk customers.

Predicting in advance whether a customer is likely to churn can inform more efficient outreach and fine-tune strategies. You can also use the collected information across all your customers in various ways beyond reducing customer churn. It can help you:

- Plan future campaigns

- Inform decisions about new products and services

- Guide customer service initiatives

- Shape strategies to boost customer satisfaction

- Improve customers’ experiences with your brand

When we talk about predicting churn, it’s not just about keeping tabs on customers who walk out the door. It’s actually a powerful strategic tool that empowers businesses to do some pretty cool things.

By understanding and predicting churn, companies can take proactive steps to foster loyalty, boost customer satisfaction, and pave the way for long-term success in a constantly changing business landscape. It’s all about using churn as a springboard for growth and improvement.

Keep your customers today and in the future with Pecan’s predictive churn analysis. Ready to get started with building a churn prediction model yourself? Then go ahead and start your free trial. Or, if you’d prefer, we can give you a guided tour.