Imagine you simply turned off all the marketing for your products or services today. All your ads and campaigns just — gone.

Would you still sell anything?

That’s an important question to consider, especially if you’re implementing marketing mix modeling (also known as media mix modeling or MMM). The whole point of marketing mix modeling is to understand how much of your revenue or another key business outcome can be attributed to each of your marketing channels. MMM yields invaluable information for allocating marketing spend across channels and aligning it with your desired results.

And yet, if all your marketing stopped, you continue seeing some results without doing anything in any channel. This is the “true organic” activity that occurs on its own, versus the simply “unattributed organic” that results from marketing but can’t be tied to a specific source. In that case, you’ve got a “baseline” level of sales or activity that would occur independently without your intervention.

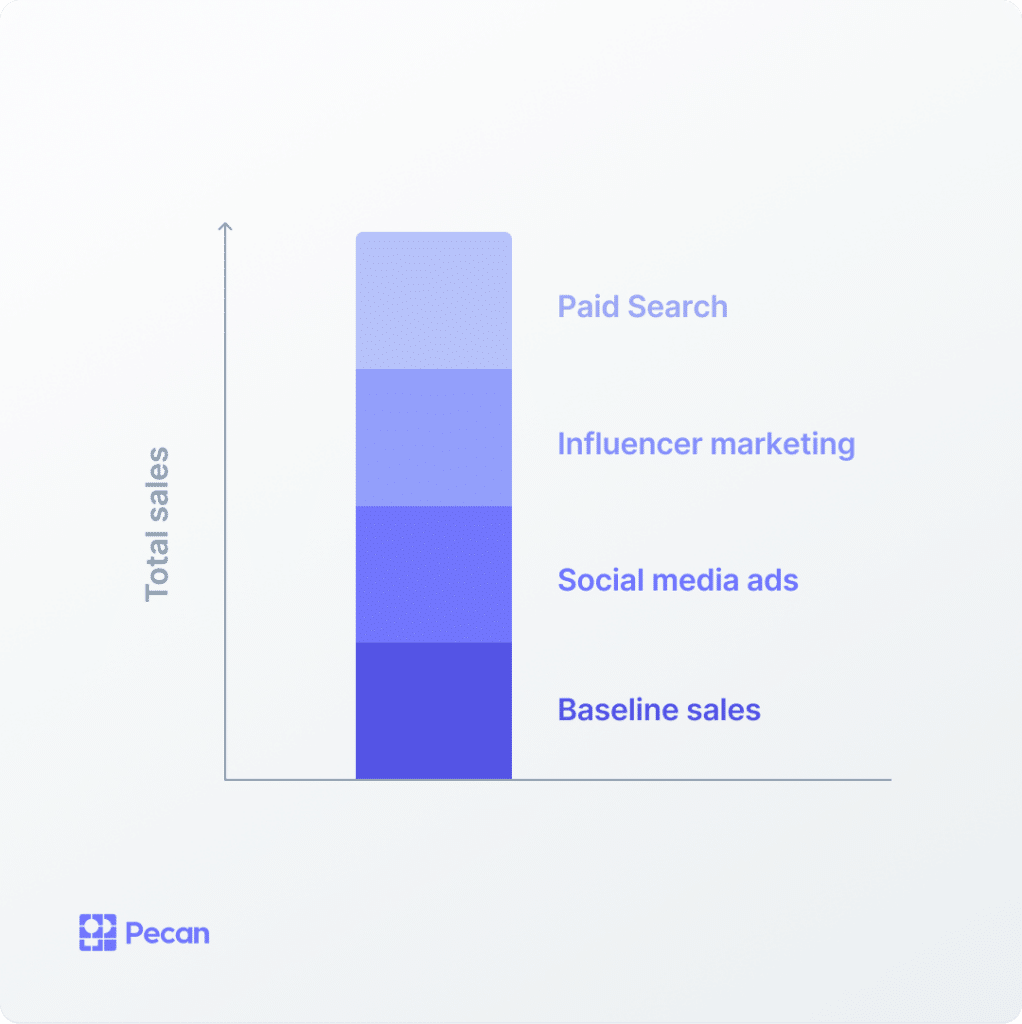

That’s an important realization in the context of MMM. The baseline sales is the amount of sales or another outcome you would achieve without marketing efforts, and without effects from other known variables like seasonality. Understanding your brand’s baseline is vital for an overall calculation of the impact of all your marketing strategies and tactics.

Some amount of sales (or another form of activity) is likely to occur regardless of marketing efforts and other known variables. However, the baseline amount isn’t constant, so imagine the baseline chunk of this bar graph fluctuating in height over time.

In this article, we’ll explore how baseline became such an important concept for businesses to grasp. We’ll also look at how baseline factors into MMM generally and how we use it at Pecan.

Understanding Baseline

Say you spotted an ad saying that your favorite cereal is going on sale at your local grocery store next week. This week probably isn’t the right time to buy three boxes and restock your pantry. Odds are, you’d wait until next week to buy in bulk and restock your pantry for weeks to come.

The CPG industry has long recognized that advertising promotional price changes in advance will affect sales. When consumers become aware of an impending sale, they reduce their consumption of a product before the sale so they are ready to take advantage of the future, lower price. Then, they purchase additional product at the lower price and store it — like your cereal stash in your pantry. Once the promotion ends and the price returns to normal, they’re still using their pantry supplies.

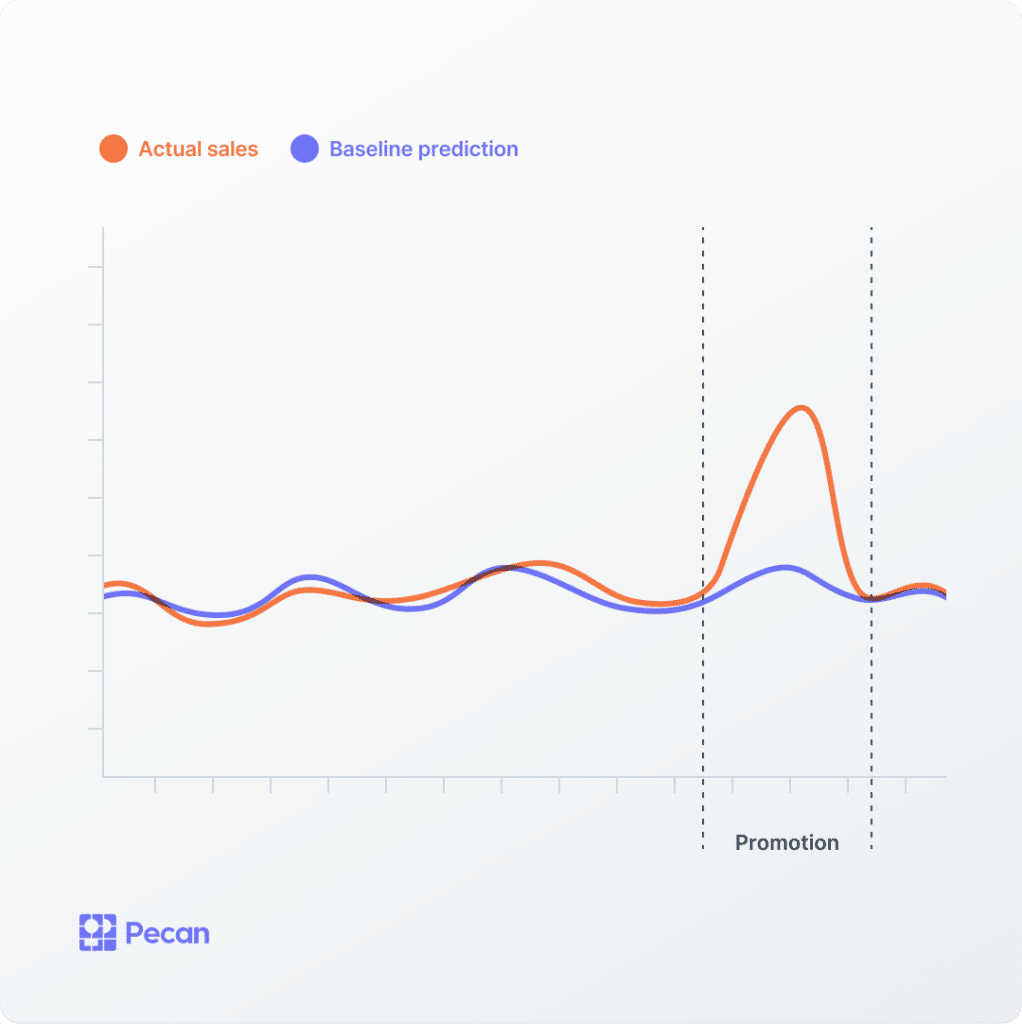

For CPG manufacturers, especially those with perishable products, it’s critical to recognize this pattern: the pre-promotion dip in sales, the promotion-period spike in sales, and the post-promotion dip. Demand forecasting requires knowing the effect of these promotional price changes on sales. And, of course, comparing the amount of sales during a promotion to the amount before the promotion can be misleading, exaggerating the effect of the promotion.

Time-series approaches to forecasting demand (such as common log-lin or log-log models) can show ghost spikes and ghost dips in their estimates of baseline sales, which will coincide with the promotion time periods. These fluctuations are misleading, though, because, by definition, baseline should not be correlated with promotional activity. Baseline is meant to capture something else.

So what is baseline capturing? Though it’s a bit mind-bending, baseline is a counterfactual. It expresses what didn’t happen.

Back to cereal: Your favorite cereal manufacturer ran a promotion and sold lots of cereal. But how much cereal would they have sold if they didn’t? They can already measure sales during the promotion, and they can measure the sales that happened at any other moment in time. But baseline is capturing the expected sales that would occur during a promotion period if they had never run the promotion (and other variables stayed the same).

In this simulated data, a promotion caused a significant gap between the estimated baseline and actual sales.

Because baseline is a counterfactual — a thing that didn’t happen — it’s not a firm number. Instead, it’s represented by a model or a predicted value.

Additionally, not only is it an unknown value, but it’s a value without any kind of real ground truth. For example, in the case of your cereal, there’s always a price; we can’t observe the demand for cereal without considering the effects of the price.

What About Marketing Mix Modeling?

Let’s dive deeper into models. Marketing mix modeling assumes that spending money in various marketing channels drives results, such as sales, lifetime value, installs of an app or software, or paying users. (We’ll refer to the results as the “target” from here on, since the outcome of interest could include a variety of metrics.)

However, as we’ve already discussed, even if all marketing channels were turned off, the target wouldn’t simply become zero. For instance, you’d probably still keep buying your favorite cereal, even if you never saw another ad for it.

Some of that continuing activity would represent short-term carryover effects, which are captured in MMM. And yet, even once the carryover effect is “used up,” some activity would persist.

We could consider a whole series of features to explain this persistent activity, and then assign the rest to the incremental impact of marketing, such as brand equity, market share, and demand. Maybe the cereal’s well-known brand will continue to attract buyers, maybe it has a large proportion of shelf space due to its popularity, or maybe people are just huge fans of that cereal and will buy it no matter how it fades from public awareness.

Challenges in Estimating Baseline

As described above, brand equity and these other potential features are great to include in MMM, when it’s possible. However, it can be extremely difficult to identify and measure them.

Even if we can capture this information, it’s usually only available to us at a high level of temporal granularity (e.g., quarterly, not daily), collected with a considerable lag (usually only in the following quarter), and not always on the same level of granularity as the target and marketing data. We might have CPG data only at the regional level, or mobile gaming data at the platform level. These factors can make this information challenging to include in the model.

A naive way of working with baseline is often to estimate it as a single-valued constant. Notably, this is the approach used in some open-source MMM libraries. This method doesn’t include how baseline may vary over time, which omits invaluable information.

Another way to estimate baseline is by switching off all marketing channels for a certain period. However, it’s not clear this approach will work for these reasons:

- Switching off all channels for a short period won’t be long enough to reveal an accurate baseline, as that carryover effect will persist and be difficult to exclude. Turning off marketing channels for a longer period is a big ask for many businesses who understandably would fear the opportunity cost of such a strategy.

- Switching off all channels for a brief period won’t provide many data points to estimate baseline. As a result, the MMM model may end up being less accurate for this period in order to be more accurate overall. This issue could be alleviated by weighting this period more heavily, but it’s what you might call a “short blanket problem”: Adjusting in one area leaves other areas prone to issues.

Overall, switching off all channels for one period would be risky. It will only provide an accurate estimate of baseline for a short period — and, in reality, baseline is likely to change over time and not be constant.

It’s counterfactual, not constant, and hard to estimate — so is there an approach to estimating baseline that avoids these issues and can reliably guide the usage of MMM for marketing decisions?

Innovative Ways of Estimating Baseline

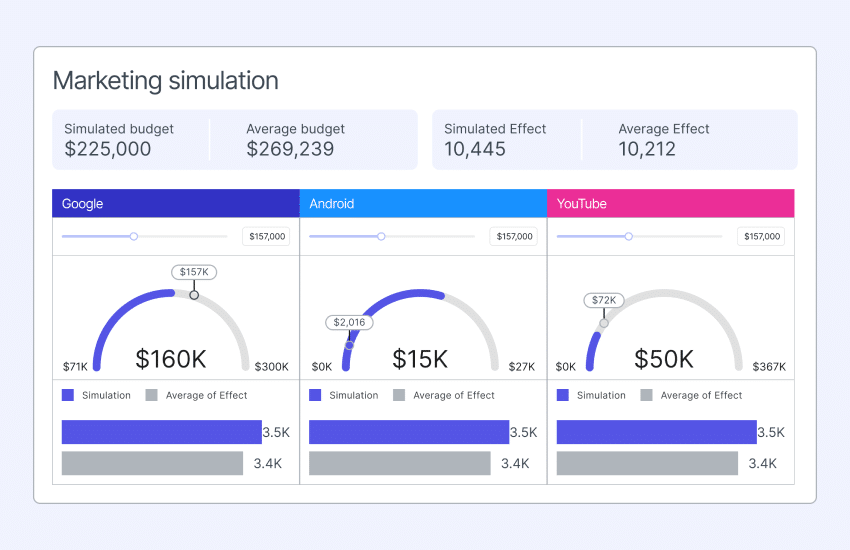

At Pecan, we’ve developed a way to use a general linear state-space model with an intercept to predict baseline in the context of MMM.

Use a…what? Yes, we know. It’s a long name for a complex mathematical modeling technique. But it’s not so out there.

These models are most often used to model dynamic systems — where there are a lot of constantly shifting, moving parts that aren’t easily observed on their own, but that together produce an observable outcome of some kind.

For example, think of a car with its hood closed. You can’t easily know from the outside at any given moment exactly how, and how much, each part is contributing to the car’s forward motion. But you know that together, the parts of the engine are propelling your car down the road.

This kind of model can help pinpoint what each part contributes to that forward motion, even without firsthand observation. And that actually sounds a lot like how marketing works, too. Without a model, it’s difficult to know how much every marketing channel contributes to your business’s growth — but the right modeling approach reveals those contributions.

State-space models contain “hidden” layers where the state equation isn’t considered constant over time. Those layers include “state variables” that capture the current status of each component in a dynamic system (think: the status of each part in the engine of the car). These individual statuses aren’t directly observable but are critical to determining the system’s behavior over time. That also means that the state-space’s intercept isn’t constant over time but instead ebbs and flows.

In MMM, we include other features like the marketing budget, seasonality, channel interactions, and so forth, in the model. Therefore, this model’s intercept can capture the true baseline effect on the target.

Additionally, if there are those “known unknowns” — the concepts we think influence the target, but that we can’t directly measure and include in the model — the baseline feature will also capture these concepts. Interpreting baseline is then possible within the larger context of the features we used, making it a meaningful guide for decisions about the marketing mix.

Innovating for State-of-the-Art MMM

At Pecan, we’ve experimented with this method and many others for building trustworthy, accurate marketing mix models. In this case, it means working on new ways to measure something that, by definition, doesn’t actually exist. As you can imagine, that’s both a fascinating and somewhat odd way to spend my work hours.

But it’s well worth it to see the impact that a well-crafted marketing mix model can have on a business’s efficiency and growth. We’ll continue to partner with our customers on refining MMM with the latest research and further innovations.

Recommended reading: Check out “A Model to Improve the Estimation of Baseline Retail Sales,” a paper by researchers Kurt A. Jetta and Rengifo Erick, which was a valuable reference for our work on estimating baseline.