In a nutshell:

- Customer acquisition cost (CAC) payback measures cost to acquire a customer vs. revenue generated.

- LTV:CAC ratio helps determine budget for acquiring new customers.

- CAC payback period calculates how long it takes to break even on acquiring each customer.

- Lower CAC payback period is ideal, typically around 12 months for startups.

- Predictive analytics can accelerate payback period by predicting customer behavior and maximizing ROI.

Customer acquisition cost (CAC) payback is a metric that measures the relationship between the cost to acquire a new customer and the annual revenue generated from that customer.

This metric is closely related to customer lifetime value (LTV). In fact, both metrics consider a customer's monetary value compared to the cost of acquiring the customer.

The relationship between these two metrics is usually referred to as the LTV:CAC ratio. This ratio helps determine the budget needed to acquire new customers.

Furthermore, LTV:CAC ratios can help you understand whether you’re spending too much on customer acquisition initiatives or missing out on opportunities in the marketplace.

In addition, a second useful calculation, the CAC payback period, also tells you how long it will take to break even on acquiring each customer.

These are popular metrics for companies like SaaS companies and direct-to-consumer businesses to use.

How Are the LTV:CAC Ratio and CAC Payback Period Calculated?

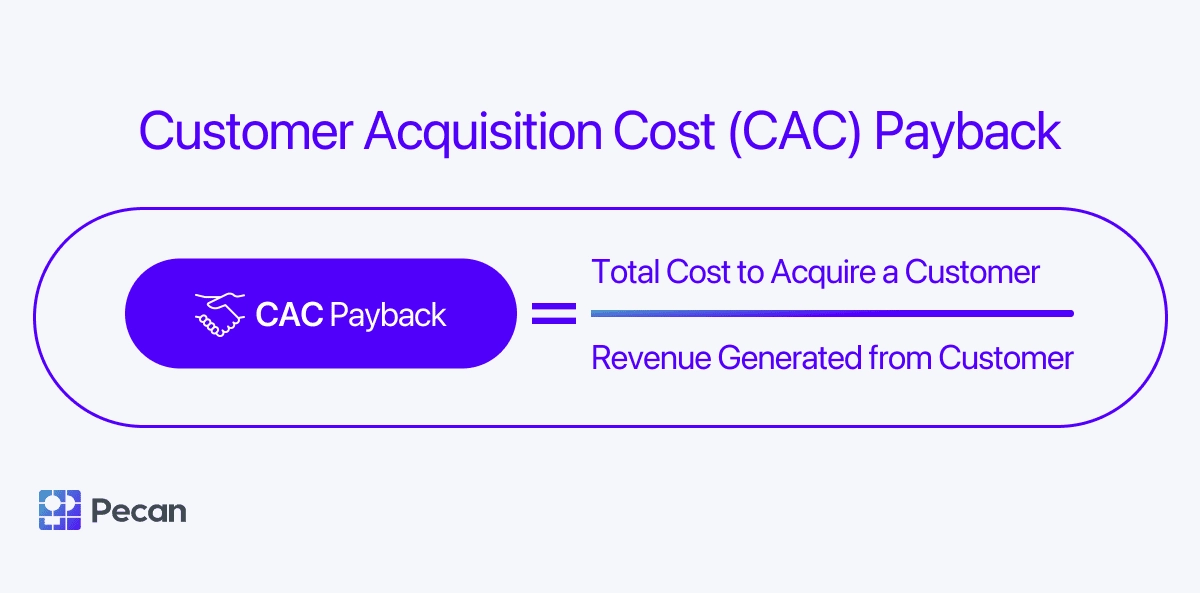

The CAC payback period formula is usually as shown below:

CAC payback formula

You can then multiply the ratio by 12, representing the 12 months in the year, to find out how many months it will take to reach the break-even point on the cost of acquisition for that customer.

For example, let’s say you operate a subscription business charging $7.99 a month. Over the course of a year, a subscriber will generate $95.88. To acquire this subscriber, you ran a Google Adwords campaign that cost $75.00. Based on the above approach, your payback period would be:

$75.00/$95.88 = .78 (LTV:CAC ratio)

.78 * 12 months = 9.36 months

Therefore, it would take just over 9 months for you to recover the cost of customer acquisition for your subscription business.

What Is a Good CAC Payback Period?

According to many online resources, the customer acquisition cost payback period is usually measured in months, with a lower payback period being the ultimate goal. A number of reports offer benchmarks that can help you optimize your business to drive more efficiency.

For startups, the typical payback period is around 12 months, but in some cases, the CAC payback period can be as high as 15-18 months. To be sure, these differences may be related to your specific industry, the nature of your products and/or services, and the cost of what you sell.

How Can I Accelerate the Payback Period?

There are undoubtedly numerous ways to accelerate the time to pay back. Most of these are related to the traditional four Ps of marketing.

- Price: Research how your product is priced in the market. Explore whether you can adjust your price to drive more sales opportunities. In most cases, setting your prices too low will lengthen this period.

- Promotion: Consider ad campaigns or demand-generation tactics to drive interest and sales inquiries.

- Place: Evaluate the placement of your product promotions and who you are reaching with your advertisements. A great way to accelerate payback is to optimize your advertising conversion rates.

- Product: Ensure your product is clearly and articulately described on your website and in marketing collateral. Highlight core customer pain points that your product/service resolves.

How Does Predictive Analytics Drive CAC Payback?

Predictive analytics helps accelerate the payback period through four core predictive modeling techniques.

To this end, a few examples of predictive analytics for payback are:

- Predictive Lifetime Value: With predictive lifetime value, you’re able to predict what a customer’s lifetime value will be in 30, 60, and/or 180 days from now. Knowing this information, you can adjust service levels, promotional offers, and other customer-focused activities. Adjustments may either increase the customer’s value or lower the costs associated with servicing the customer.

- Conversion Rate Modeling: With conversion rate modeling, create proactive measurement strategies that forecast conversion events. You can fill data gaps and select campaign optimizations based on future customer buying behavior.

- Upsell/Cross-Sell Predictions: Predict which customers will buy more and which will buy accessories and complementary products. This predictive approach is a great way to drive higher lifetime value and lower your payback period from months to weeks.

- Churn Predictions: Predict which customers are likely to churn. Identifying these customers sooner, prior to fulfilling payback, will ensure you maximize return on investment.

In any case, it’s always easier to boost revenue from existing customers than to acquire new ones.

Paying attention to your LTV:CAC ratio and your CAC payback period is an important way to ensure you’re seeing maximum return on acquisition costs as rapidly as possible. Predictive analytics offers vital insights into customers’ futures to inform this effort and help your business grow.

Find out more about how Pecan can help you with CAC payback. Get a guided tour.