In a world where most companies collect zettabytes of data on their customers, it’s often surprising how little they actually understand the people must fundamental to their success.

It doesn’t matter how large your data lake is (or how well-integrated Firebase is into your app) if you don’t use that data to make key marketing, customer service, and sales decisions.

We know this isn’t easy, but with the right tools and strategy, you can use customer behavior analysis to understand the data and put it to use. (Unfortunately, you can’t ask ChatGPT to do predictive analytics for you just yet.)

To help you get started, we’ll do a deep dive into what customer behavior analysis is, why you need it, and how to do it effectively using modern tools like AI.

What is customer behavior analysis?

Customer behavior analysis is the art and science of figuring out how customers or prospects feel about your company and what they’re likely to do next.

You do this by dissecting customer behavior — how customers interact with your brand before and after making a purchase.

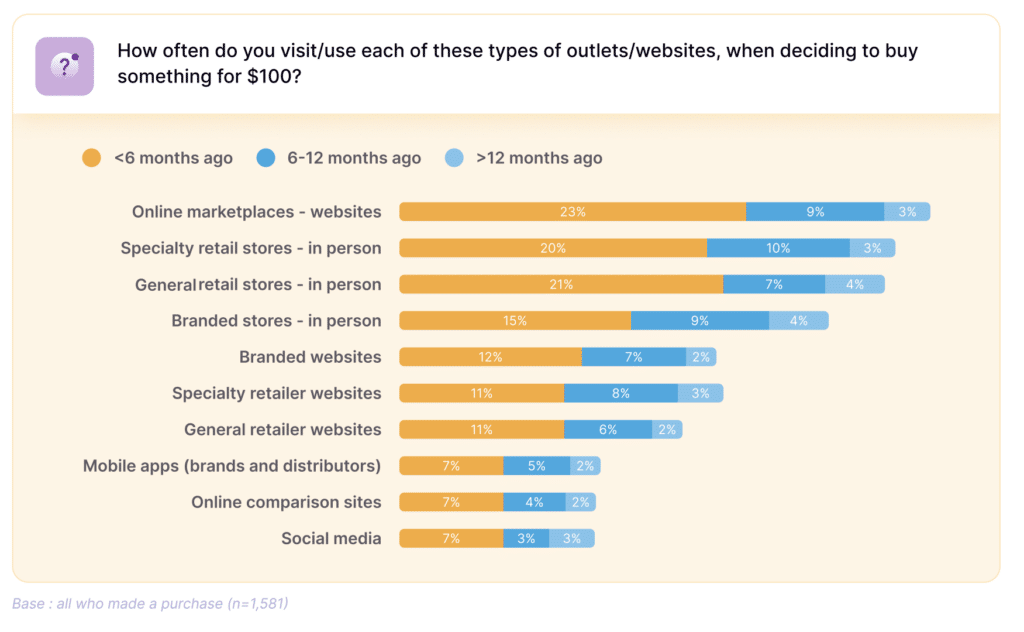

In days past, this might’ve been as simple as talking to the few customers who walked into your store. Today, customers use a wide range of touchpoints (both digital and retail) to interact with companies.

Online marketplaces, social media, mobile apps, retail stores, and resellers are all major channels leading up to a sale.

Post-sale, you also have your help desk, call center, and other channels to track and worry about.

A robust customer behavior analysis strategy mixes quantitative data from these channels with qualitative data from surveys and customer interviews to better understand how your customers feel about your business.

This is easier said than done, which is where AI comes in.

The role of AI and machine learning in customer behavior analysis

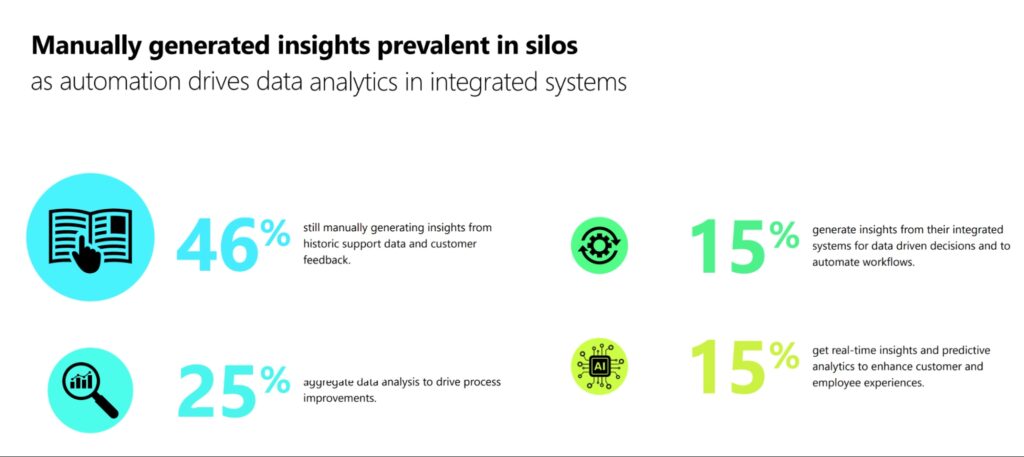

While 46% of companies are today still manually generating customer insights based on various sources, this is typically due to data silos and poor systems.

Forward-looking companies instead use predictive analytics to enhance the customer experience.

The predictions provided by machine-learning algorithms won’t just help your analysts decode countless customer data points. They will also give your sales and customer service reps timely instructions on delivering the experience each customer or prospect wants.

You can also use predictive analytics at a higher level to predict campaign performance. If you’re a marketing manager who’s marketing products, you no longer need to rely on “intuition” — AKA guesswork.

Instead, a model trained on your data can predict which leads are likely to convert into paying customers at an early stage. That gives you a viable data point to help you make better campaign optimization decisions earlier in the campaign.

Why customer behavior analysis is crucial

Modern consumers know you’re collecting data about them and expect their customer experience to reflect that. In 2021, 76% of consumers reported feeling frustrated when they didn’t get personalized interactions. This means that analyzing what customers want and enjoy can be essential to maintaining customers and keeping them engaged. Doing this analysis now rather than later can reduce chargebacks and customer churn.

Spot concrete issues before they lead to losing customers

Calculating customer churn isn’t enough to stop your customers from leaving for legitimate reasons.

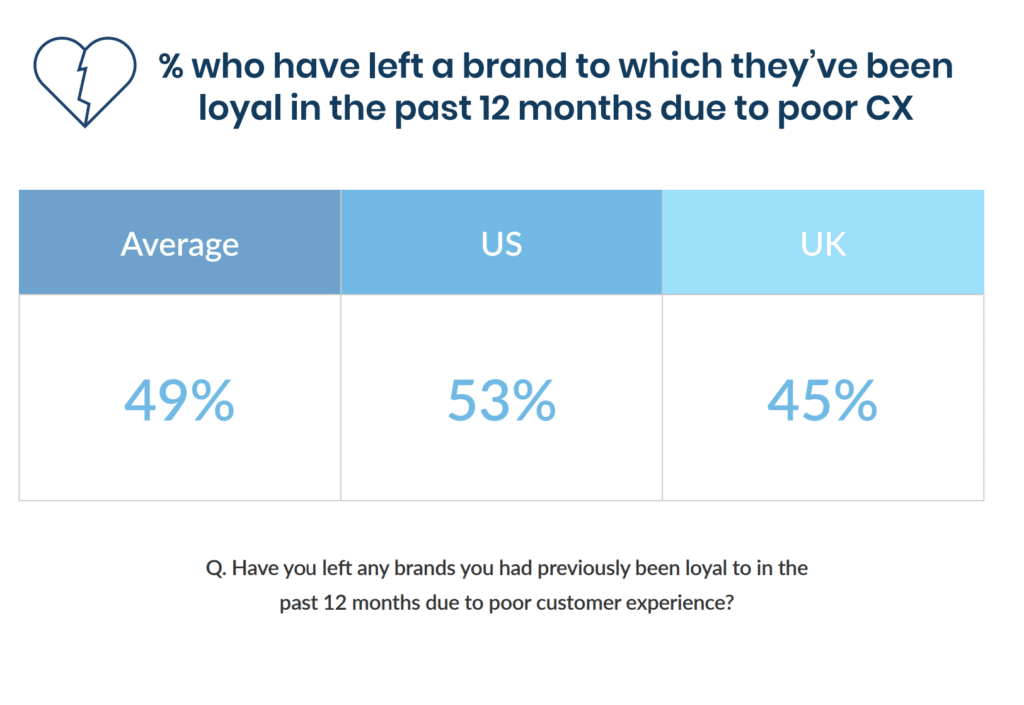

In 2022, 86% of consumers said they would switch brands after one to three negative customer experiences. 49% said they had left a brand they used to be loyal to over the past 12 months.

To minimize this issue, actively monitor your customers’ experiences and take the initiative to solve problems when they come up. Predictions delivered at a granular customer level can help you understand the primary drivers of potential churn or other customer activity.

Good customer behavior analysis allows you to identify key markers of issues before the customer has to reach out themselves. It’ll also give your support reps and product managers the context to drive a better customer experience.

Sell and market your products more effectively

With a cohesive image of your prospects and their real-time status, you have a much better chance of turning them into customers.

It’s not always easy to visualize what this would look like, so here’s a concrete example: Hydrant used Pecan to create models that predicted existing customers that were likely to churn. Then, they designed targeted win-back campaigns that delivered 2.6x higher conversion rates compared to their average campaigns.

Reduce the impact of chargebacks and other fraudulent transactions

Chargebacks cost sellers a whopping $20.1 billion in 2021. And it’s not just e-commerce stores. Any company that uses credit card transactions is vulnerable.

You can identify common factors by analyzing the segment of customers that use chargebacks. Doing this manually is a taxing process that involves hundreds of hours of analysis.

With Pecan, Coinmama saved 140 hours per month of their analysts’ time by accurately predicting which transactions were at risk. That reduced the number of transactions in manual review by two-thirds.

How to develop an effective customer behavior analysis strategy

Now that you understand the why, let’s talk about how you can create an effective strategy for your own company.

1. Define your highest-priority objectives

Before you can start making your customer journey and experience better, you need to figure out your most important goals.

Here are a few guiding questions you can use when analyzing your company’s performance:

- What areas are we struggling in — marketing, sales, onboarding, or retention?

- Are our marketing campaigns delivering a positive ROI?

- Which areas are hindering our ability to meet quarterly or annual objectives?

- How are market trends and other outside factors impacting our company?

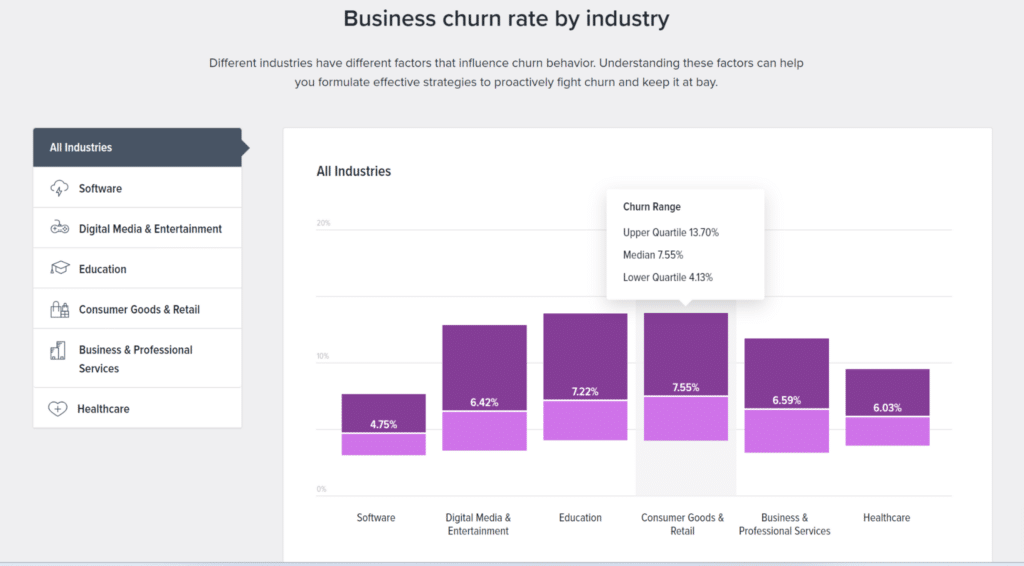

For example, let’s say that your customer churn rate is higher than industry benchmarks. In the consumer goods industry, the average is 7.55%, but your company’s rate is above 20% per month.

In that case, you need to focus on customer retention. Focusing here will be much more impactful than any new acquisition marketing campaign.

2. Unify data sources for a cohesive image of your customer

Before you can make educated decisions based on customer data, you need to ensure that that data is high-quality and representative of the customer journey.

You want to gather and centralize quantitative data on your customers like:

- Engagement data: How your customers engage with your brand on your website, social media, and other channels.

- CRM data: Purchase history, customer support interactions, and more.

- Campaign performance data: Conversion rates, customer acquisition costs, new customer lifetime value, and more.

- Usage data: How users use your app, software, or product.

Larger companies usually achieve this with custom solutions like a data warehouse or a customer data platform.

If you don’t already use a data warehouse, make sure you use analytics platforms that support your existing customer data sources. For example, Pecan integrates with both Salesforce and Firebase. That lets you create models considering both in-app signals and interactions with your sales or service teams.

3. Understand different customer buying behavior patterns

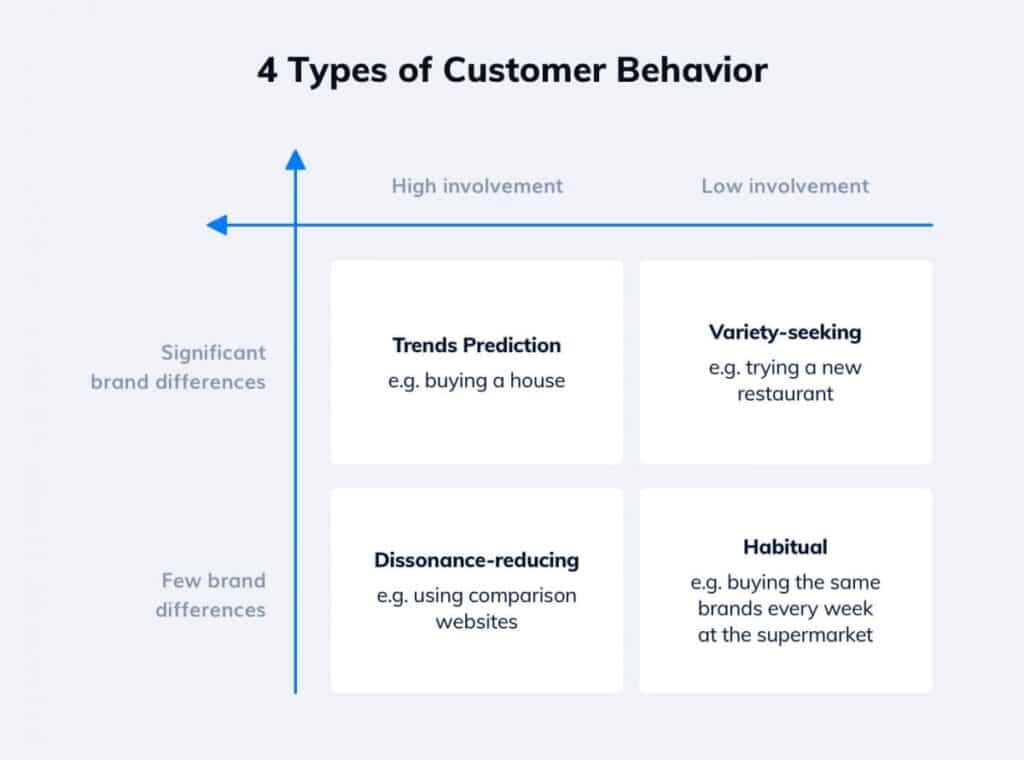

Most marketers use some variation of Henry Assael’s customer behavior model when breaking down different types of customers. Assael categorized other buying behaviors based on the level of involvement and brand differences.

- Complex buying behavior: Consumers go through complex buying behavior for large purchases requiring research — think of a new house, computer, or car.

- Dissonance-reducing buying behavior: In product categories with few concrete differences — say, wall paint — the consumer chooses a brand based on identity. Your job is to ensure that your marketing message speaks to the identity of your ideal customers.

- Habitual buying behavior: For fast-moving consumer goods like tissues, soda, or toothpaste, brand loyalty is often ingrained into a habit. Most people don’t think twice when they pick a 6-pack of Coca-Cola out in the store. They just do it.

- Variety-seeking buying behavior: In industries where consumers value variety — for example, restaurants, packaged food — you need to factor this in.

You need to understand where your product lies. If not, your marketing strategies won’t match the real consumer behavior that drives purchases.

4. Segment your customers based on objectives and behavior

In a marketplace increasingly focused on personalization, you can’t treat your whole customer base equally. You need to recognize the needs of different types of customers to serve them effectively.

Here are a couple of customer segments you need to treat with special care:

- Customers who didn’t onboard effectively. These customers are likely to churn. Use engagement metrics to highlight users who never completed key tasks, like creating their first report. Then, you can create special reengagement campaigns to avoid unnecessary churn.

- Your most loyal customers. Figure out what makes them tick to adjust your marketing efforts to attract similar customers.

The key to customer retention is to segment your customer base effectively and serve their needs.

If you don’t want to do this manually, you can create predictive models that segment your audience for you.

5. Identify patterns manually or use predictive analytics

In the past, customer behavior analysis was a very involved process that required lots of manual analysis.

You can still do it that way, but the reality is that it’s much simpler and faster to use predictive analytics software. With a low-code platform like Pecan, your analysts can easily create models that identify valuable patterns.

Other companies have used Pecan to:

- Focus on high-value leads thanks to predictive lead scoring, including estimated LTV.

- Focus retargeting campaigns on prospects that are likely to become customers.

Pre-built SQL templates make data importing easy, and our intuitive interface makes it easy to create predictive models.

6. Use surveys to supplement your quantitative data

If you have a large customer base and a data set to match, predictive analytics alone will give you a deep well of information to guide action.

But if you have a smaller customer base and a longer sales cycle, it can be useful to supplement with qualitative data from surveys or customer interviews.

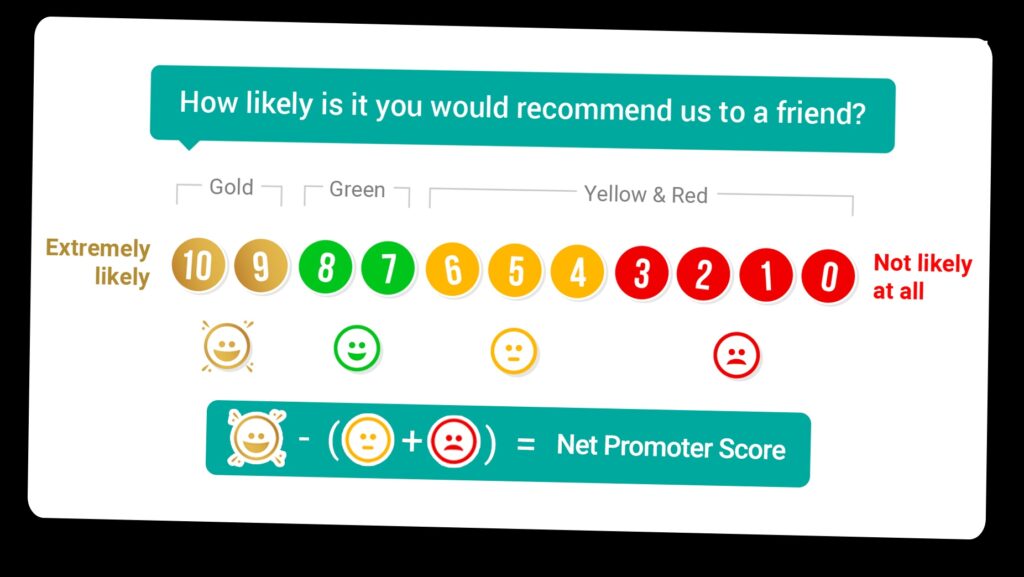

If your product is an app, you can set up a simple NPS survey.

This can be another opportunity to leverage customer behavior analysis — identify key actions that are likely to represent a negative customer experience and send an automated survey request at that time, or invite customers to reach out to support.

7. Optimize your campaigns or customer experience based on new insights

Once you have insight into your customer behavior, you must use it. Translate the behavioral insight into a concrete action like this:

- Are customers who don’t open onboarding emails 50% more likely to churn? Optimize the email subject lines and send times to boost open rates.

- Are prospects who have visited case study pages more likely to convert? Adjust more of your retargeting budget to that audience.

8. Actively track the results and adjust your course when needed

Don’t immediately move on after implementing your improvements. You don’t even know whether it is an improvement at this stage.

Optimizing the customer experience is an iterative process — measure, optimize, measure, optimize, and so on.

The good news is you already know exactly what to measure since you identified the issue based on a key metric; that should be the KPI you use to measure the impact of the change. Whether that’s the conversion rate, retention rate, or something else depends on each case.

Experience the future of predictive customer behavior analytics with Pecan AI

The main challenge with customer behavior analysis used to be the analysis. You had to assemble a team of experienced analysts, process data from various sources into the same format, and then manually create complex models to identify patterns.

With Pecan AI, our platform does the heavy lifting for you. It allows a smaller team to directly import customer data through native integrations and run that data through existing models — or create their own using our low-code platform.

Our machine learning algorithms will identify patterns and make useful predictions, such as which leads are likely to convert, which customers are likely to churn, and more.

If you’re looking for a better understanding of your customers, sign up for a 14-day free trial today.