In a nutshell:

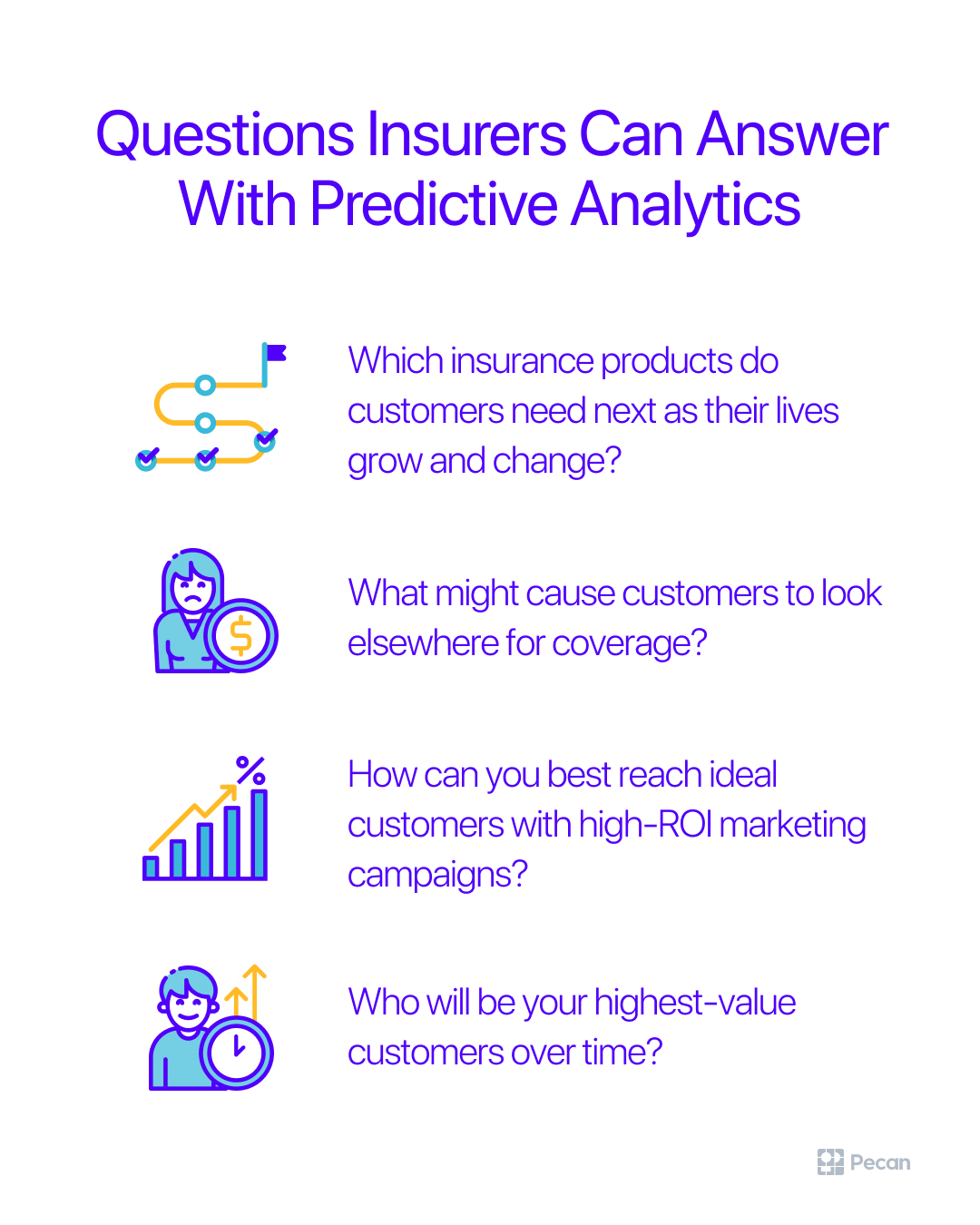

- Predictive analytics is increasingly used in the insurance industry to improve profitability and customer service.

- It can help insurance companies minimize costs related to customer service and optimize resource allocation.

- Predictive analytics can also identify cross-selling opportunities and improve customer satisfaction.

- By anticipating customer needs, insurance companies can offer personalized and timely offers, increasing customer retention and profit margins.

- Pecan AI offers a low-code predictive analytics platform that allows insurance companies to quickly build and deploy models for better data-driven decision-making.

The insurance industry is partly built on accurate predictions: An insurance provider sets premiums based on projected costs from insurance claims. Therefore, it’s only natural that predictive analytics would find a home in the insurance industry. Powered by artificial intelligence and machine learning, predictive analytics in insurance uses large data sets to analyze patterns and predict events like damage, fraud, and policy cancellation.

For many years, actuaries have used mathematical models to forecast the risk of injury, property loss, and various types of damage. But increasingly, insurance companies supplement traditional approaches with high-powered predictive analytics. This modern approach is proven to increase profit margins, boost productivity, increase sales, and provide better customer service. A Willis Towers Watson Life study found that life insurance companies using predictive analytics saw a 67 percent drop in expenses and a 60 percent boost in sales.

Predictive analytics is a growing trend in the insurance industry, offering numerous applications and benefits. It enables insurers to make informed decisions, optimize resource utilization, identify potential markets, and provide a personalized experience for customers. It also helps in risk and fraud detection, claims processing, and agent fraud detection.

Indeed, the future success of insurance companies depends on their ability to take advantage of digital transformation and their data sets, according to Deloitte’s report on the insurance industry. The Willis Towers Watson Life study mentioned above also revealed four key factors that life insurance companies rated as driving forces behind the adoption of big data analytics for risk and insurance:

- Competition in pricing and product development

- Earnings and profitability

- Technological innovation

- Customer relationship management

The same report identified three areas where predictive analytics will likely have the most significant positive impact:

- Decreasing expenses

- Increasing sales

- Increasing profitability

Among European insurance companies, over 80% of companies that already use predictive analytics stated in a survey that the technology has positively affected their business, and none reported any negative results.

-

- Insurers can find many applications for predictive analytics across departments

Using Predictive Analytics in Insurance Companies

Predictive analytics in property and casualty (P&C) insurance involves collecting and analyzing data from various sources to gain insights into customer behaviors, trends, and actions. By leveraging internal and external data, insurance carriers can anticipate future customer behaviors, sentiment, and activities, enabling them to make informed business decisions. This historical data can be collected from customer-agent interactions, telematics, social media, and other sources.

Predictive analytics has several applications in P&C insurance. It can help identify fraudulent claims and assess risk levels. In life insurance, it can reduce underwriting expenses and improve sales. Additionally, predictive analytics can help insurers identify customers at risk of canceling their contracts and take proactive measures to retain them. It can also streamline the claims management process by automatically detecting urgent or questionable claims.

Predictive analytics solutions for insurance companies can also be used to identify and increase the number of cross-selling opportunities. The legacy approach to cross-selling involves sales representatives offering expanded insurance bundles to existing policyholders. However, this approach typically results in low cross-sell conversion rates, inefficient use of sales team labor, and decreased customer experience. Using historical sales and customer data, predictive analytics can be used to identify customers who are most open to cross-selling.

Predictive modeling has been shown to improve cross-selling campaigns significantly. Insurers see higher sales, greater return on labor investments, and improved customer satisfaction scores. That said, predictive analytics for insurance can support greater customer satisfaction in ways that go beyond cross-selling.

Overall, predictive analytics in insurance enables insurers to generate new insights into customer preferences and make data-driven decisions to enhance their business operations.

Proactive Strategies for Insurance with Predictive Analytics

Today’s customers want companies to not only meet their current needs but also anticipate future needs. Predictive analytics can help insurance companies approach customers with personalized, well-timed offers based on their likely insurance needs. Importantly, this is more efficient and proactive than relying on direct mail and advertising to bring in customers.

There are also several general business use cases for predictive analytics in the insurance industry. In marketing departments, predictive analytics can uncover campaign insights using product types and demographic data. The technology can reveal consumer preferences and the likelihood of consumers engaging with different messaging, enabling dynamic customer engagement. The result is an increased return on marketing spend while avoiding costly marketing mistakes.

Predictive analytics can also retain customers before they churn, optimizing customer lifetime value and improving customer loyalty. Using customer data, predictive analytics can use behavior patterns to predict customer churn, with accurate predictions for various insurance products. Because gaining new customers is much more expensive than retaining existing customers, this application of predictive analytics can significantly boost profit margins.

In addition, reducing customer churn has also been shown to attract new customers. Satisfied customers become brand advocates for the business.

These uses of predictive analytics can all provide a competitive advantage for insurers.

Converting Data to Insights to Action with Predictive Analytics

By making predictions using large amounts of data, predictive analytics can help insurance companies with all kinds of business functions, from upselling and cross-selling to underwriting. Let’s break down the predictive process into five distinct steps based on using a powerful, user-friendly platform like Pecan.

- Data connections. Predictive models can easily be set up to integrate with existing data collection architecture. If companies already use Salesforce, Snowflake, Hubspot, or Microsoft SQL Server for their analytics operations, adding predictive analytics to the mix is simple.

- Predictive GenAI-directed model building. Through natural-language chat, Pecan's Predictive GenAI guides you in defining a predictive question that can be answered with a model based on your raw data. Auto-generated code kickstarts your model, which the Pecan engine then automatically builds. The model uses hidden patterns in your data to generate predictions. With those predictions, you can take more informed, timely, and impactful actions.

- No-code integration of predictions into business workflows. Predictions generated by the models then flow to business systems — such as CRMs, ERPs, and other databases — where they inform decision-making.

- Ongoing usage and feedback. Business objectives and data usage may change after deploying a predictive analytics system. Ongoing monitoring and model refinement will help the system maintain its significant value.

Challenges and Benefits of Using Predictive Analytics in Insurance

Lack of transparency and accountability when algorithms are used to guide decisions.

One significant challenge in implementing predictive analytics in the insurance industry is the lack of transparency and accountability in algorithmic decision-making.

Insurance companies use complex algorithms to assess risk, set premiums, and make coverage decisions. However, these algorithms are often viewed as "black boxes," making it difficult for customers and regulatory bodies to understand the factors influencing these decisions. This opacity raises concerns about fairness, bias, and potential discrimination.

Generally, algorithms used for marketing purposes (e.g., for identifying customers interested in purchasing additional products) are not as risky as those used to identify potential fraud or determine pricing. However, there's still great value in choosing a predictive analytics platform that offers "explainable" predictions. This capability is essential for assessing fairness and gaining additional insights into model predictions.

Insurers must work to improve transparency by providing clear explanations of their models and ensuring accountability in their decision-making processes to build trust and ensure fair and ethical practices within the industry.

Empowering customers with predictive analytics in insurance

Predictive analytics improves the insurance customer's experience by providing personalized insurance options. By harnessing data and sophisticated algorithms, insurers can create customized coverage plans that align with each individual's requirements and risk profile.

This hyper-personalization strategy ensures that customers receive insurance solutions that meet their needs and provide better value for their unique circumstances, ultimately enhancing customer satisfaction and the overall insurance experience.

An Example of Predictive Analytics Success in Insurance

CAA Club Group (CCG), serving 2.5 million members, has found a powerful ally in Pecan's predictive analytics and AI demand forecasting for its roadside assistance services.

By leveraging Pecan's AI forecasting capabilities, CCG optimally schedules its rescue vehicles based on highly granular predictions of member call volume. Before adopting Pecan, manual forecasting took a week for each set of forecasts, while Pecan significantly streamlined the process. CCG sought a scalable, automated solution to handle vast quantities of data and continuously refine models.

Pecan met their needs by providing expanded modeling capabilities, easy experimentation, and the ability to create highly detailed forecasts for specific locations, times, and service types. This approach has allowed CCG to improve service, reduce response times, and enhance member satisfaction across their entire region, all while boosting the efficiency of their in-house data science team.

Optimizing Insurance Company Operations with Pecan AI

Our low-code predictive analytics platform enhances insurance companies’ existing analytics capabilities, allowing them to extract even more value from the data they already collect.

Instead of hiring a team of data scientists, an insurance company’s in-house data analysts and business professionals can easily build models. Then, they can quickly deploy them using their SQL skills and analytics knowledge without additional advanced training. As a result, our insurance clients quickly put predictions to work and rapidly see a return on their investment.

Alternatively, we're here to help guide your AI journey if you'd like more help along the way. We can support you with a dedicated customer success manager and data analyst who help guide the implementation of your predictive strategy.

Contact us today if you want to learn more about how Pecan can quickly boost your insurance company’s KPIs through the power of prediction.